This is complicated stuff, so make sure to speak to an attorney that specializes in older law or a legal facility prior to looking for a reverse home loan program. Bankrate's content team writes in behalf of YOU-- the viewers. Our objective is to give you the most effective advice to help you make wise personal financing choices. We comply with strict standards to make certain that our editorial material is not influenced by marketers.

To dispute details in your individual credit score record, merely follow the instructions provided with it. Your individual credit scores record includes ideal get in touch with details including a web site address, toll-free phone number as well as mailing address. Whether you are buying an automobile or have a last-minute expenditure, we can match you to car loan deals that fulfill your needs and budget plan. If you owe a lending institution a significant piece of the equity in your home, there will not be much left for the nursing home.

When the customer of a reverse mortgage dies, the financial institution will discuss lending settlement alternatives with the beneficiaries and educate them of the present home loan equilibrium. The beneficiaries will typically have 1 month to determine what to do with the funding and also with the property. Exclusive reverse home loans aren't guaranteed by the federal government, therefore consumers aren't called for to pay a monthly insurance costs or to take financial therapy. In 2021, the principal restriction for this kind of lending is $822,375, and also there are no problems on just how reverse home loan borrowers can utilize the cash. You'll be required to attend a HUD therapy session with a counseling company and also pay a mortgage insurance coverage premium. As a result, Congress took action to provide the Federal Real estate Administration much more flexibility when handling the HECM reverse home mortgage program.

- It is always better to find various other services to your financial demands, if possible.

- Neither is your credit history if you are getting a HECM financing, though if you have any kind of outstanding debts like government trainee car loans you will certainly not be accepted.

- Unless you want to live life in a motor home, you possibly will not sell your house and Click here for more placed the cash in your bank account.

- MyBankTracker has actually partnered with CardRatings for our insurance coverage of charge card products.

- Make sure you recognize exactly how a reverse mortgage works and also exactly how it can influence your house equity gradually.

- The point of views expressed are the author's alone as well as have actually not been supplied, approved, or otherwise recommended by our partners.

Because an HECM for Purchase includes purchasing a brand-new primary house, the down payment on the new home undergoes specific policies. For instance, if closing costs are financed, the minimum needed down payment is typically between 29% to 63% of the purchase price. Much like a routine HECM, this sort of home loan is backed by the FHA. Also, like most reverse home mortgages, it has a non-recourse clause, indicating that you can never ever owe more than your house's worth when the finance comes to be due.

Bankrate adheres to a stringent editorial plan, so you can trust that our content is sincere as well as accurate. Our prize-winning editors and also press reporters produce sincere and also exact web content to help you make the right financial choices. The web content created by our content staff is objective, factual, and not influenced by our marketers. Bankrate complies with a stringent content plan, so you can trust Click for source that we're putting your rate of interests first. Founded in 1976, Bankrate has a long record helpful individuals make smart monetary selections. We have actually preserved this reputation for over 4 decades by debunking the economic decision-making process and giving individuals self-confidence in which activities to take next.

Is A Reverse Mortgage Worth It?

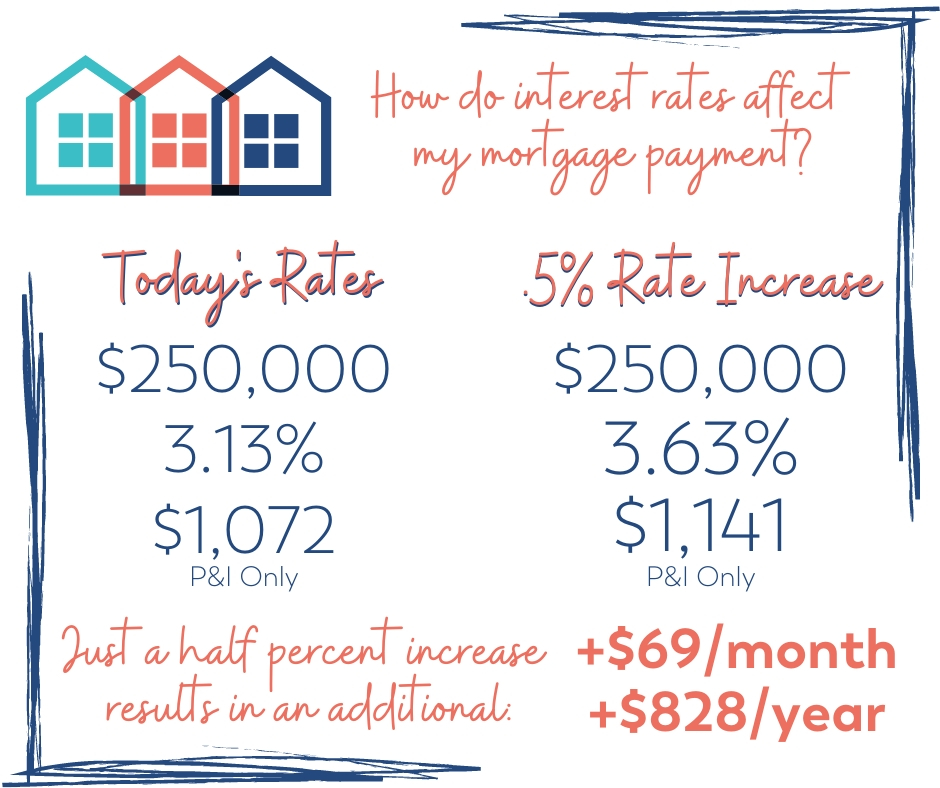

Your rate of interest will certainly have an effect on just how much you qualify for. Due to the fact that rate of interest charges are included in your financing each month, the reduced the rates of interest, the a lot more you'll have the ability to borrow. According to the FHA, some pockets of the area have even higher default prices. In Midtown Waterfront as well as the Orangecrest community near March Air Get Base, the default rate is 14%. These numbers go beyond the nationwide rate of FHA home loans that are dealing with default or foreclosure.

Pros & Cons Of Reverse Home Mortgages & Options

Before you make any kind of decisions on a reverse home mortgage, consult with a specialist that knows the timeshare specialists reviews ins and outs of every little thing to do with mortgages. Our trusted friends at Churchill Home loan will outfit you with the information you require to make the best decision. There are likewise lots of costs on these finances, making it all even worse. " Reverse home mortgages are heavily managed," states Mitchell.

CFPB and also FTC have actually been taking steps to enhance housing counseling, yet more stringent enforcement as well as sharing of finest practices have to be raised. Congressman Mark Takano will certainly be sending out a letter to both the CFPB and also FTC urging them to maintain stringent enforcement and oversight of real estate therapy sessions. Improving therapy sessions as well as enhancing customer protections will assist to safeguard senior citizens from unscrupulous loan providers. Cuts to funding for real estate therapy have stretched therapists thin. Federal funding must be reinstated to insure that therapists can continue to be objective as well as give the best possible info.

Have financial resources to continue to make prompt repayment of continuous property taxes, insurance coverage and also Homeowner Association fees, and so on. This is one obligation that needs to be attended to prior to receiving a reverse mortgage. You must either pay the government judgment completely or prepare an adequate settlement plan in between yourself and the federal government prior to your reverse home loan can shut.

Keep in mind that reverse home mortgages aren't solely meant for single-family residences-- you can likewise request one if you stay in a condo, as long as it's your key residence. A residence equity finance lending permits you to borrow as much equity as you require in a lump sum with a fixed-rate payment. Home equity fundings typically come in terms of five to 15 years, but you'll require to reveal you make adequate revenue to certify. To determine term and also line of credit options, it's ideal to get in touch with reverse mortgage policemans that have actually specialized lending software to do the estimations for you. You can choose regular month-to-month repayments for as lengthy as you or a co-borrower reside in the home as your main home. The Department of Housing and Urban Development calls for consumers to total therapy prior to securing a reverse home loan, however the intricacy of the transaction still leaves numerous seniors confused.