Not all companies will certainly allow you to utilize among the government's newbie purchaser efforts. However, a much more adaptable company might allow it, as long as you satisfy Find more info their various other needs. The tables below will certainly give you a concept of how most likely you are to get a funding based upon the sort of credit rating concerns you have as well as how much time you could have to wait before pressing ahead. These providers often base their lending choice on the cause and also severity of the damaging, the age of the credit report concern, and just how carefully you satisfy their various other eligibility and also cost needs. Mortgageloan.com ® is a registered solution mark of Icanbuy, LLC. You do not also need to wait that wish for your credit history to recuperate.

- If you currently have a government-backed funding, you may remain in luck.

- We will certainly consider your circumstance and also area your information with one of the most appropriate lender.

- If you have actually paid your rental fee, energies, or various other bills promptly, try to obtain them included.

- Consequently, you might like to wait up until any type of defaults or various other unfavorable credit score has gone away from your credit rating file prior to making an application for a home loan.

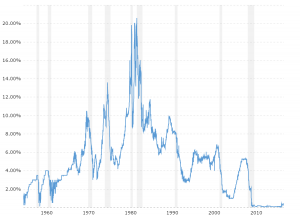

- Lenders check out elements such as the prime price to determine their prices.

That can make your home mortgage extra expensive overall, what happens if you stop paying timeshare maintenance fees which could not be perfect. The tables listed below overview the very best 5 year dealt with price home loans for consumers with some current damaging credit history (based on a lending of ₤ 150,000). Just how much you pay will rely on the size of the down payment you can put down as well as your loan-to-value. The initial step is to make certain your finances are in as good a place as possible.

We understand what inadequate credit history mortgage lenders are seeking and also whether they are most likely to approve your unfavorable debt home mortgage application. This is a fast-moving market, so utilizing a broker that works day to day with bad credit history loan providers gives you the benefit of up to day info. Lenders pleased to accept bad debt mortgages will certainly consider your credit score and also the information of your credit rating. Lenders will certainly evaluate various sorts of poor credit scores differently, as an example a missed out on mobile phone repayment is evaluated differently to a CCJ. Some bad credit score mortgage lending institutions enable a certain variety of CCJs over a collection amount of time, others will certainly take into consideration those with bankruptcies while various other will omit this. Locating the ideal lending institution that matches your credit report is considerably helped by talking to a home loan broker.

In many cases, yet certainly not all, the interest rate charged for a remortgage is much less than that for a credit card, individual funding or cars and truck money arrangement. For that reason, changing all your financial obligation to one remortgage can help to minimize your monthly cost for your financial debt. The advantage of doing this is that you have one monthly payment for your financial debts instead of several loan repayments to different lenders. This can reduce several of the anxieties that paying back financial obligations can bring however like any kind of economic agreement, there are some significant factors to consider.

The Most Common Concern http://griffingeuz241.timeforchangecounselling.com/the-fed-s-latest-relocation-will-certainly-send-borrowing-expenses-greater Is, Can I Obtain A Mortgage With A Low Credit History Or Negative Credit Report?

In this variety, it can be difficult, though not impossible, to obtain a mortgage. Those that authorize lendings in this classification are truly bad debt home mortgage lenders. It's still possible to get an FHA loan with a sub-600 score, though the deposit need increases to 10 percent for consumers with ratings listed below 580. Usually, the challenge with bad credit rating home mortgage isn't so much getting approved for them, but paying the cost. Lenders typically charge greater home mortgage rates as well as costs on mortgage with negative credit score and also might require bigger deposits too.

Home Mortgage With Dmp

This is when you could intend to begin to look for a professional who can give you specialist poor credit history mortgage advice. Getting a home mortgage when you have poor credit report can be difficult, especially if you have negative credit report, defaults, region court reasonings, home loan debts or specific voluntary arrangements. In spite of these elements however, it's possible to obtain a bad credit history home mortgage. Lots of bad credit history home loan lending institutions provide very quick turnaround times, typically within a few days. As an example, Alpine Credits and also TurnedAway both provide 24-hour approvals. You may even get your negative credit history home mortgage authorized on the same day with some lending institutions.

Can I Obtain A Home Mortgage If I Am In A Debt Monitoring Plan?

VA Loans are likewise issued by exclusive lending institutions, yet this time the Department of Veterans Affairs assures the loan rather than the FHA. There is no minimal credit score need enforced by the VA . There's additionally no down payment called for unless the residence assesses for less than you're spending for it. You do require to be a service participant or have a document of army solution, although making it through partners of servicemen and also ladies are also eligible.